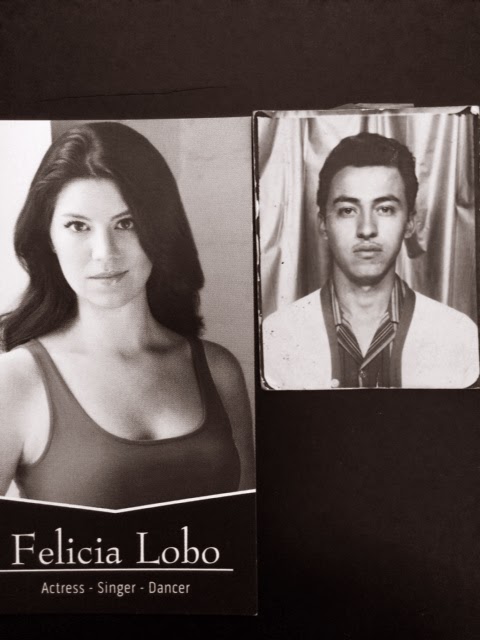

A Book Review by Luis G. Lobo

The Next America by Paul Taylor

This work by Paul Taylor and the Pew Research Center in DC

provides a window into the present demographic picture, the here and now. My friends at the Pew Center and I have developed a mutually beneficial relationship over many years through Roberto Suro, previous director of the Pew Hispanic Center and now on faculty at USC – Irvine, and Rakesh Kochhar, senior researcher at Pew.

The Next America discusses the post-Great Recession impact

on a hobbled economy during the mid-term of the Baby Boomer’s generation, and

career cycle - the last of who will “retire” in the next 10-12 years. The

over-supply of now, “can’t retire” Baby Boomers is creating a job lockout for Millennials, who witnessed the undoing of

their parent’s financial stability in 2008. Most significantly, The Next

America portrays a permanently altered national fabric, contributed by the

surge of U.S.-born children of Latino and Asian immigrants now in their 3rd

generation.

This multicultural block of U.S.-born children of immigrants

impacted the 2012 Presidential elections where the majority of Asians, Latinos,

and Blacks voted for Obama. Given the continued negative dialogue by the

Republican Party against immigrants (i.e., Latinos, Asians,), it is highly

probable that this will also impact the 2016 elections. (See Chapter 6, pp

84-86).

The role of women in America has also reached a state of

permanent change. This, along with

racial minorities predicted to become the majority by 2030 will continue to

significantly change the national fabric.

The Next America should give us pause as to how we must

reach and serve clients today. “Tomorrow” is now “Today.” We have learned

firsthand in our multicultural markets, that we must persistently be visible

where people exist. It is also imperative that we use social media, and

electronic delivery channels to drip financial knowledge on our households,

businesses, and personnel, to uncover needs they may have not yet identified as

crucial to their future and financial success (insurance, home ownership,

investments, etc.).

I believe that we must reflect the communities we

serve to be relevant and successful, thus giving us ample

opportunity to educate and serve their financial needs.

I have noted key areas to read that follow.

Thank You!

The Next America

Chapter

2: “Millenials and Boomers”

Page 24 - “In the early 1980s before most Boomers started

raising families, they were called too selfish to have children…too involved in

their lives...accused of moral relativism, too politically correct. No one

blamed the World War II generation for the Vietnam War, pollution, nor

discrimination against black, women, and gays.

Page 28 - “…born in 1984, you were in middle school when the

Columbine massacre happened; in high school on 9/11/01…”

Chapter

3: “Generation Gaps”

Page 40 – Millienial’s view of Boomers is not substantially

different of older generations and are slightly less critical of business than

the views of Baby Boomers.

Chapter

4: “Battle of the Ages”

Page 47 - Even when

multiple generation don’t live in the same home, they look after one another in

other ways…Boomers have already inherited $2.4 trillion from the Greatest

Generation with another $6 trillion forth coming.

Page 54 – 43% say the government is responsible for a

minimum standard living for older people. 40% say individuals and families are

mostly responsible. 14% say equally responsible.

Chapter

5: “Money Troubles”

Page 59 – if a 65-year old married retiree were to convert

$120,000 into a standard annuity today, it would yield $575 per month. $120,000 being the typical balance today for

the 60% that have such a program on the cusp of retirement. 75% of those on the

cusp of retirement have $30,000 or less in retirement savings.

Page 64 – Figure 5.4 – In 2011, 22% of households age 35 or

younger are in poverty.

Chapter

6: “The New Immigrants”

A. “Immigrants

are strivers”: Only the very motivated uproot themselves for economic,

religious, or political freedom. The

United States’ 325,000,000 population has 42 million immigrants and 37 million

U.S.-born children of immigrants: 24 % (immigrants and U.S.–born children of

immigrants).

B. College

entry rates: Asians - 84%, Whites - 69%, Hispanics - 69%, and Blacks - 65%

(2000-2012 high school graduates eligible to attend a 4 year college)

C. Median

household income, 2012: U.S. Population - $49,000; Asians - $66,000; Whites -

$54,000; Hispanics - $40,000; and Blacks - $33,000.

D. Read

Immigrants and Politics p.84-86.

Chapter

7: “Hapa Nation” (This term means a person that is half

of one race or mixed ethnicity).

A. 15% of all

U.S. marriages are between spouses of a different race.

B. Intermarriage

trend has risen from 2.4% in 1960 to 15.5% in 2011.

C. Read “The

Hispanic Identity Conundrum” page 97 and “The Blacks in Obama’s America”

page

99.

Chapter

8: “Whither Marriage”

Page – 108 …70% of unmarried Millenials say they would like

to get married one day. Money is holding them back…they place marriage on a

pedestal…and associate marriage with positive economic outcomes.

Page 114 – In 2011, 41% of all births in the U.S. were to

unmarried mothers, up from 5% in 1960…mostly to women in their 20s and 30s… 6

in 10 single mothers have live-in boyfriends, when they give birth.

Chapter

9: “Nones on the Rise” – (not religious)

Page – 126 – Figure 9.1: The Churching of America

Rates of church membership: 1906 – 51%; 2000 – 62%.

Page – 132 – Nor are “nones” uniformly hostile towards

organized religion. A majority think that religious institutions can be a force

for a good society.

Chapter

10: “Living Digital”

MUST READ – “Natalie was born in 1988 and was 18 in 2006

when her digital life on message boards began.

Natalie is a digital native, now 26. Natalie has always been

“connected,” this is her principal method of assembly and awareness.

Chapter

11: “Getting Old”

Page 163 – Figure 11.2 - % saying that a person is old when…has

gray hair (13%); Turns 85 (79%).

Chapter

12: “Empty Cradle, Gray World”

Page 171 – Japan’s baby bust is the most acute in the world,

but similar dynamics are taking hold on every continent.

Page 173 – The fertility rate (U.S.) is among the highest in

the wealthy world (Just under 2 per woman). The bulk of the global population

growth will come in the poor countries of Africa and Asia.

Chapter

13: “The Reckoning”

Page 184 – The young today are paying taxes to support a

level of benefits for the old that they themselves have no prospect of

receiving when THEY become old.

Page 194 – Going forward, it’s unrealistic to expect

families to take on more of the challenges of caring for the elderly; it’s

quite possible they will do less.

Appendix:

Includes an excellent array of charts and tables relates to

specific chapters.

http://www.amazon.com/The-Next-America-Millennials-Generational/dp/1610393503

www.LuisLobo.Biz